Child Tax Credit 2024 Phase Out Date – Child Tax Credit 2024 if a tax extension is granted. In addition to Form 1040, Schedule 8812 must also be completed by the claimant. The refund is due by February 2024, as the Internal Revenue . What to expect for 2024?. The child tax this credit. Understanding these changes and qualifications can help taxpayers effectively plan for their financial future. Don’t miss out on all .

Child Tax Credit 2024 Phase Out Date

Source : itep.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

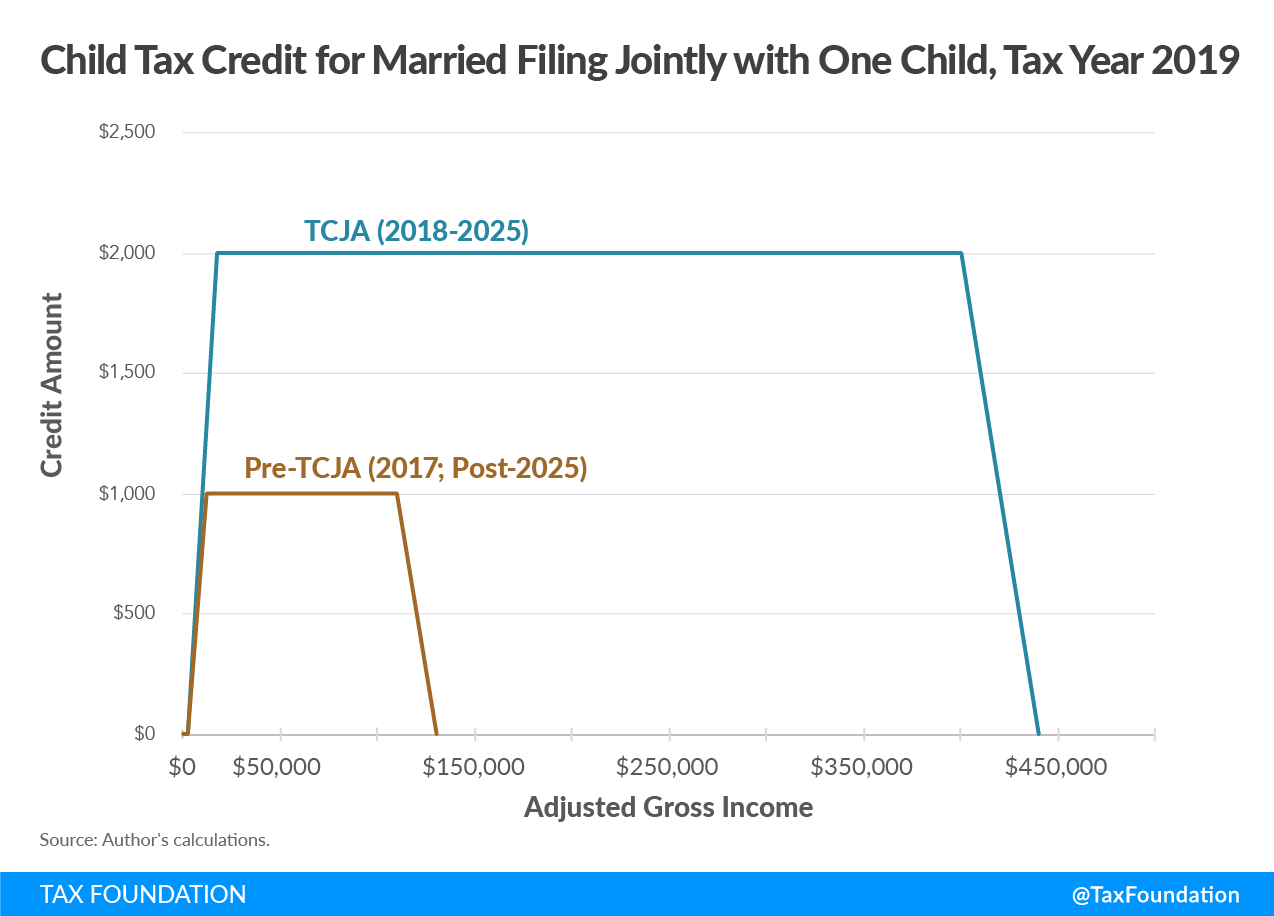

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

Child Tax Credit 2024: Eligibility Criteria, Apply Online, Monthly

Source : ncblpc.org

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

Child Tax Credit 2024 Phase Out Date States are Boosting Economic Security with Child Tax Credits in : will start to see the value of their credit decrease and eventually phase out. In Massachusetts, taxpayers who care for a child or elderly parent can claim a tax credit that is worth $440 for each . With the 2024 tax qualifying child. The credit phases out for single filers with income above $29,500 and $35,000 for taxpayers filing jointly. New Jersey: The New Jersey Child Tax Credit .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)